Why Victoria’s ban on networks offering gas appliance rebates is a win for energy consumers

View Press Release

On 18 April 2024, Victorian energy minister Lily D’Ambrosio gazetted an order under the Gas Industry Act to prohibit Victoria’s gas distribution networks from providing rebates or incentives to purchase new gas appliances. This follows through on the state government’s promise from its Gas Substitution Roadmap Update in December 2023.

Several gas distribution businesses, who are responsible for delivering gas to households for heating, hot water and cooking, have offered rebates in recent years to encourage customers to purchase new gas appliances.

For example, Victoria’s Multinet Gas Network has previously offered rebates of up to $500 for the purchase of new hot water or heating appliances, and up to $100 for gas cooking appliances. Multinet ended its Natural Gas Rebate Campaign on December 2023, and now states that “No other offers are available for our Victorian customers at this time.”

Australian Gas Networks offered similar rebates for new gas hot water systems. While these also concluded for Victorian customers in December 2023, they continued to be offered for customers in South Australia, New South Wales and Queensland up to 31 March 2024.

While a rebate on the upfront cost of a new gas appliance may appear appealing to customers, they ultimately benefit gas networks far more than they benefit gas consumers.

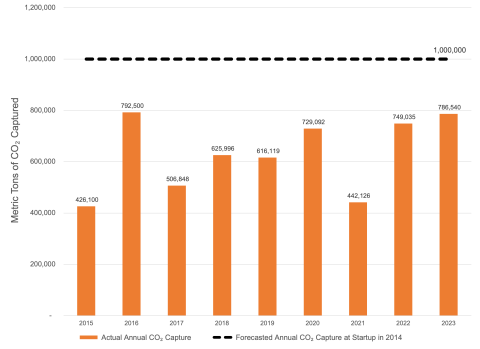

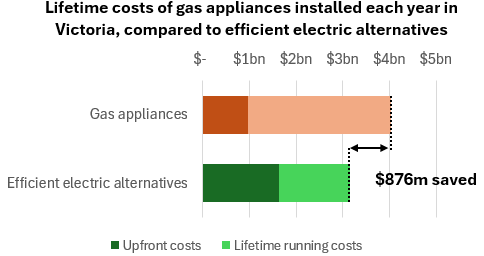

IEEFA’s analysis shows that when both upfront and ongoing running costs are considered, Victorians are locking in nearly $900 million in unnecessary lifetime costs for each year that new gas appliances are installed rather than efficient electric alternatives.

Gas appliance rebates only reduce the upfront cost of an appliance. However, as the graph above shows, this is small compared to the running costs, which on average make up 75% of the cost of ownership of a gas appliance.

And in Victoria, around a third of those running costs are passed back to gas networks. In some states, network charges make up an even higher portion proportion of gas bills; exceeding 60% in Queensland and Tasmania.

Victoria’s policy to prohibit these rebate schemes is a sensible step that protects consumers. However, it does highlight a broader underlying issue. Under our current regulatory system, gas networks are incentivised to sell more gas to more customers at a time when we need to be planning for a managed phase-down of gas.

Gas is no longer the cheap household fuel it once was. IEEFA’s research has found that a typical Victorian home could save $1,200 a year on their energy bills by replacing their gas appliances with efficient electric alternatives. This adds to a growing body of research showing that all-electric homes are the most cost-effective option for Victorians.

The Australian Energy Market Operator forecasts a long-term decline in residential and commercial gas consumption in their central Step Change scenario, and in fact downgraded these forecasts even further in its recent 2024 Gas Statement of Opportunities. IEEFA has noted several factors that could lead to even faster declines than what is forecast.

Gas distribution networks themselves have acknowledged that electrification is the most likely pathway forward for Victorian homes, particularly in light of recent policies including the state’s Gas Substitution Roadmap.

Multinet has stated that “The [Gas Substitution Roadmap] reduces the uncertainty by making clear the intent of the Victorian Government to focus on electrification, particularly for residential customers.”

AusNet, which operates another Victorian gas distribution network, has noted “the [Gas Substitution Roadmap] provides more certainty around the primacy of the electrification pathway to decarbonise.”

In 2023, Victoria’s gas distribution networks asked the regulator to bring forward over $460 million in charges on customer bills over the next five years. This is a strategy called accelerated depreciation, which allows networks to write down the costs of their assets faster, mitigating their stranded asset risk – the risk that these businesses will be unable to recover their costs if in the future customers leave the network.

Of this proposed amount, $333 million was ultimately approved by the regulator. This means, paradoxically, that Victorians who took up gas appliance rebate offers are not only locked into high ongoing running costs, but those running costs include a premium to compensate networks for the risks associated with other households getting off gas.

In other words, gas distribution networks have transferred some of their stranded asset risks onto their customers, and subsequently encouraged those customers to increase their exposure to those risks.

This is not the only example where gas distribution networks’ dealings with the regulator appear to be in tension with their communications to customers. Previous IEEFA research highlighted that ‘renewable gas’ campaigns present risks to both the networks and consumers, and do not acknowledge the economic and financial reality that hydrogen and biomethane are not viable fuels for most households.

Incidentally, the gas appliances targeted by these rebate programs are not compatible with hydrogen. Research partially funded by gas networks suggests that if a 100% hydrogen pathway was pursued, households would need to buy new hydrogen-ready appliances, which aren’t yet available on the market.

Sensible state and federal policies can help consumers in the transition to efficient electric appliances, and there is an increasingly strong case for a more holistic plan to manage the phase-down of gas distribution networks.

The federal government is currently consulting on a plan to reduce emissions in Australia’s electricity and energy sector, and has acknowledged that “the gas regulatory framework needs to be fit for the future.” This represents a key opportunity to examine the current state of gas network regulations, and identify the changes needed to allow for a managed phase-down of networks in a way that works in the long-term interests of consumers.

This article was first published in ReNew Economy.

To read more of IEEFA’s research related to electrification and gas distribution networks, see Managing the transition to all-electric homes and ‘Renewable gas’ campaigns leave Victorian gas distribution networks and consumers at risk.