Company turns halt of gas-to-methanol project into permanent cancellation

Key Findings

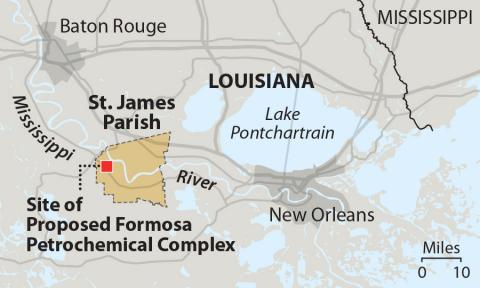

Big Lake Fuels has asked the Louisiana environmental permitting agency to rescind the company’s existing permit to build a methanol plant.

The request comes after 10 years of permit deadlines that have come and gone, along with the promises of jobs and taxes.

Time, resources, and community patience have been wasted that could be better spent on real and sustainable economic development.

A company that had announced a temporary halt of its plan to build a 1.4 million-ton methanol plant near Lake Charles, La., has decided to cancel the proposed facility and decline the permit issued for it.

Big Lake Fuels, a subsidiary of Switzerland-based Proman AG, asked the Louisiana Department of Environmental Quality in February to rescind the document.

The company was initially granted a permit in May 2014 to build Big Lake Fuel Methanol Plant (BLFMP), a natural gas-to-gasoline production facility. But the project suffered several missed construction start deadlines, permit extensions, design alterations and a name change.

The rescission letter offered no detailed explanation for the company’s reasons. A review of project documents and various commentaries, however, suggests the project had become an unattractive business proposition at a time of changing markets and rising sustainability concerns.

On its website, Proman AG highlights the Varennes Carbon Recycling project in Quebec, suggesting that sustainability investments are the wave of the future. News reports on Proman point to its green methanol projects in South America and Europe. The BLFMP project was envisioned as a traditional methanol project using natural gas feedstock. Proman AG is a leader in the field and is looking to gain a foothold in the U.S. market. BLFMP offered nothing new or innovative at a time when companies with sustainability plans are expected to invest in those plans. The green methanol outlook for the United States is particularly robust.

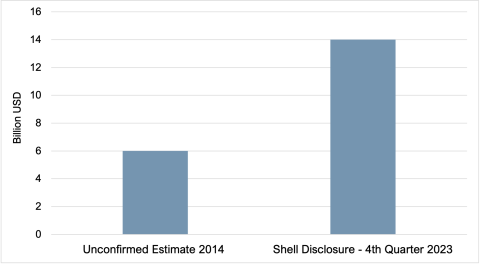

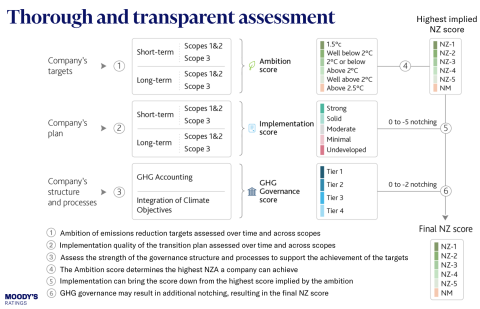

All three major rating agencies (Fitch Ratings, Moody’s Ratings and Standard and Poor’s) have recently lowered the outlook for Consolidated Energy—the principal financial backer of BLF. A combination of structural factors, the changing nature of the markets due to sustainability, weakening prices, uncertain demand and poor business planning have led to overleveraging and a slumping outlook.

The tangle of corporate players that support the project’s business structure—BLF, Consolidated Energy, Oman Methanol, G2X Energy, Proman AG and Helm AG—form a network that lacks transparency, so the cancellation of the project could actually prove beneficial to the company’s credit position.

The company’s regional methanol assets are anchored in Trinidad and Tobago. The utilization rate for the company’s Trinidad and Tobago methanol assets are targeted at 80%, which would be higher than the typical mid-60% range for the region and world. The risk of underperformance from weak GDP growth or other market factors would have a considerable impact on the financial profile of the Proman/Consolidated Energy business structure, and BLFMP could have been perceived as competing against the Trinidad and Tobago assets.

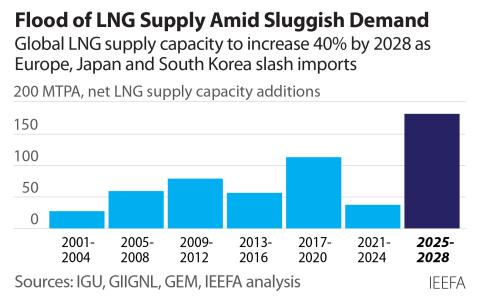

Finally, a spate of new methanol projects are being considered in Texas and Louisiana. A shakeout period is inevitable since the market appears to be adding capacity rapidly. Rising supply, construction prices and the potential for a prolonged period of lower commodity prices are likely to push down investment returns and profits. Also, the potential for rapidly rising amounts of renewable methanol entering the market poses a market wild card that could slow the traditional absorption rates that the industry expects during periods of surplus.

The story of BLF’s methanol project raises a larger planning and economic development problem. Market forces are changing rapidly, and projects planned 10 years ago are no longer relevant. Petrochemical producers cannot be depended upon as community partners to launch projects that can help build sustainable communities.