Key Findings

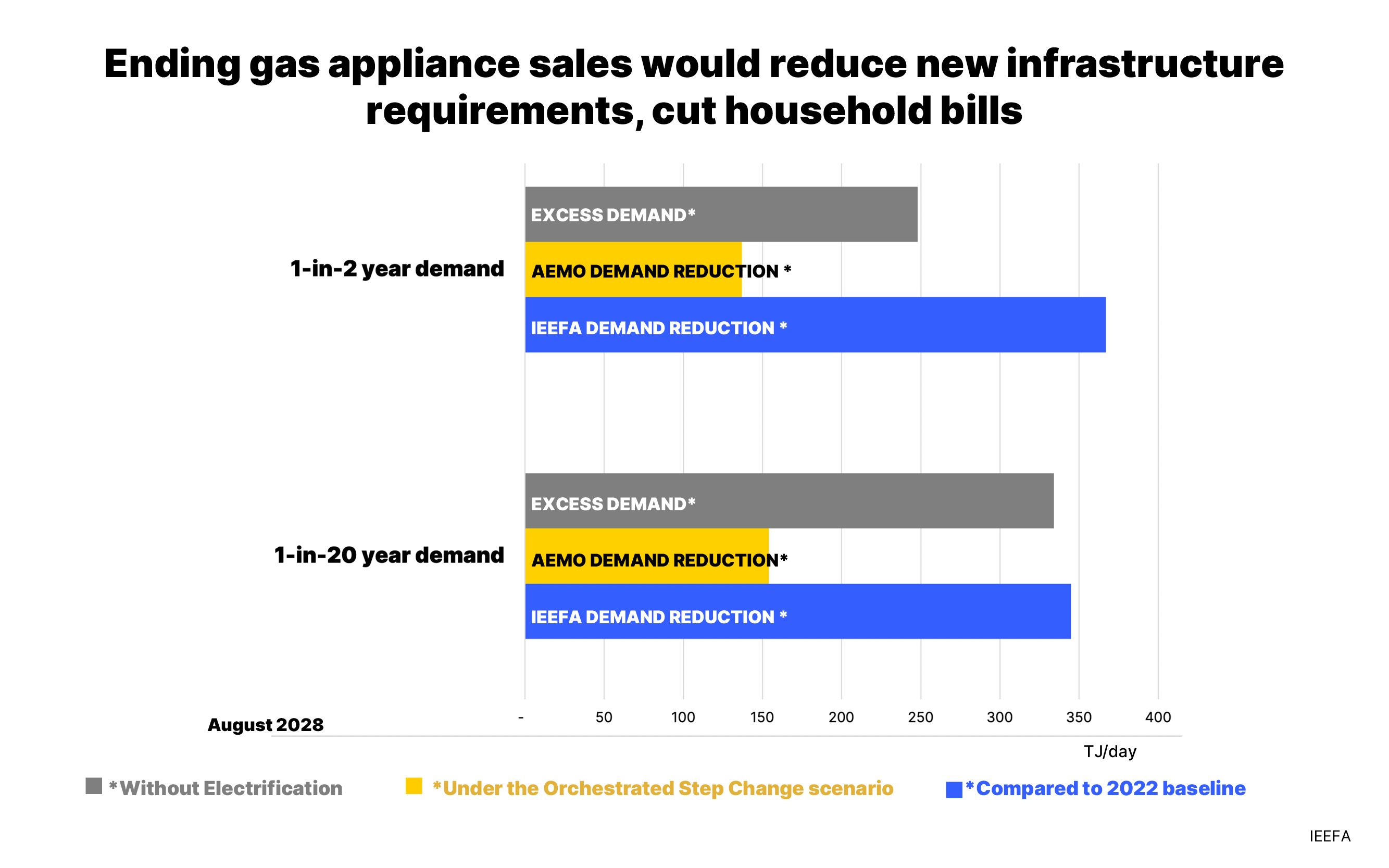

AEMO forecasts that Victoria's gas demand may outstrip supply on peak days due to peak demand not decreasing as quickly as peak gas supply.

Cost-effective and targeted interventions to lower gas demand could materially lower peak day gas demand and eliminate the risk of peak day excess demand events in Victoria.

This would lower household energy bills and help avoid the need for additional gas supply or infrastructure, which is likely to increase household energy bills.

Ending the sale of gas appliances, particularly gas space heaters, delivers the largest reductions in gas demand given Victoria's high gas demand for winter heating.

Executive Summary

The east coast of Australia faces the prospect of excess gas demand in coming years due to declining gas production, with the imminent possibility of short-lived periods of excess demand in Victoria on peak demand days. However, IEEFA’s analysis shows that cost-effective and targeted interventions to lower gas demand could fully eradicate anticipated peak day excess demand in 2027 and 2028, provided action is taken soon enough.

The Australian Energy Market Operator (AEMO), in its 2024 Gas Statement of Opportunities, forecasts that southern east coast states are likely to face excess gas demand on annually from 2028, on a seasonal basis from 2026, and on a peak day basis from 2025 under extreme demand conditions. In Victoria, which has the highest gas demand on the east coast (excluding demand for LNG exports), AEMO forecasts peak day excess demand up to 65 terajoules (TJ) in a 1-in-20-year scenario in 2027, and up to 94TJ/day and 185TJ/day under 1-in-2 and 1-in-20-year scenarios respectively in 2028.

IEEFA’s analysis shows that cost-effective, targeted gas demand reduction interventions would lower peak day demand enough to eradicate anticipated peak day excess demand under AEMO’s 1-in-2 and 1-in-20-year scenarios. Most of this decrease would come from reduced demand for residential heating. Some of the gas demand reduction interventions will lead to additional electricity demand. However, we calculated that even if all the additional electricity was generated by gas-powered plants, the interventions would still be enough to eradicate the excess gas demand in the 1-in-2-year scenario. In the 1-in-20-year scenario, at least 75% of additional electricity demand would need to be generated from other sources, such as batteries and electricity imports from Tasmania.

These interventions would also lower household energy bills. For example, if gas appliances were replaced by efficient electric appliances at the end of their life, the average Victorian home could save $1,200 a year on its energy bills. Further, we estimate that each year of delay to ending the sales of new gas appliances costs Victorians a collective $876 million in locked-in lifetime costs. Implementing both energy efficiency and electrification interventions in parallel will deliver additional financial benefits, such as ensuring that new equipment is not oversized or unnecessary.

These measures can also reduce gas users’ exposure to volatile gas prices, which are likely to worsen in a tight gas market. The tightening outlook in recent years has already driven gas prices well above historical levels, with some users reporting that unsustainable prices and could force them to close. For example unanticipated coal generation outages in 2022 caused a spike in gas demand, which resulted in prices spiking in AEMO’s gas spot markets. This led to AEMO implementing a $40 per gigajoule (GJ) cap in the Victorian market. Excess demand in Victoria on peak demand days would similarly cause gas prices in the spot markets to soar with potentially serious impacts on industrial users, small businesses and electricity generators (as well as the gas retailers supplying them).

Source: IEEFA

Improving gas efficiency and increasing the use of highly efficient electric appliances would have the double benefit of reducing market tightness and increasing the predictability of energy bills. Indeed, it would increase the share of costs associated with capital investments compared with variable energy costs, which would smooth out energy costs throughout the year. For example, we calculated that a household’s winter energy costs would be only 90% higher in winter compared with summer by using heat-pump based appliances compared with 167% higher for gas-based equipment.

There needs to be a greater focus on the demand side of the demand and supply equation, particularly for those gas users who can most easily switch away from gas and will have the largest benefits. The Australian Competition and Consumer Commission (ACCC), which to date has largely focused on supply-side measures, acknowledged in late 2023 the need for further measures to reduce gas demand on the east coast. In IEEFA’s view, the need for demand reduction will only increase as the supply outlook worsens – urgent action is needed now to lower gas demand.

This analysis, while indicative, presents a compelling case for further investigation, and IEEFA encourages the Australian and Victorian governments to further consider these interventions. The alternative would be costly supply-side solutions that lock in higher energy bills for households during a cost-of-living crisis and potentially further expose gas users to volatile international gas prices.