Key Takeaways:

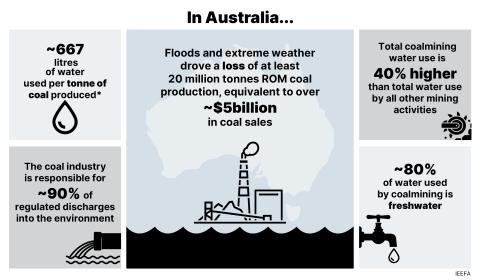

Investors and shareholders in Australian coalmining could feel the pinch as water-related risks increase amid worsening climate change impacts, tighter regulations and growing community opposition.

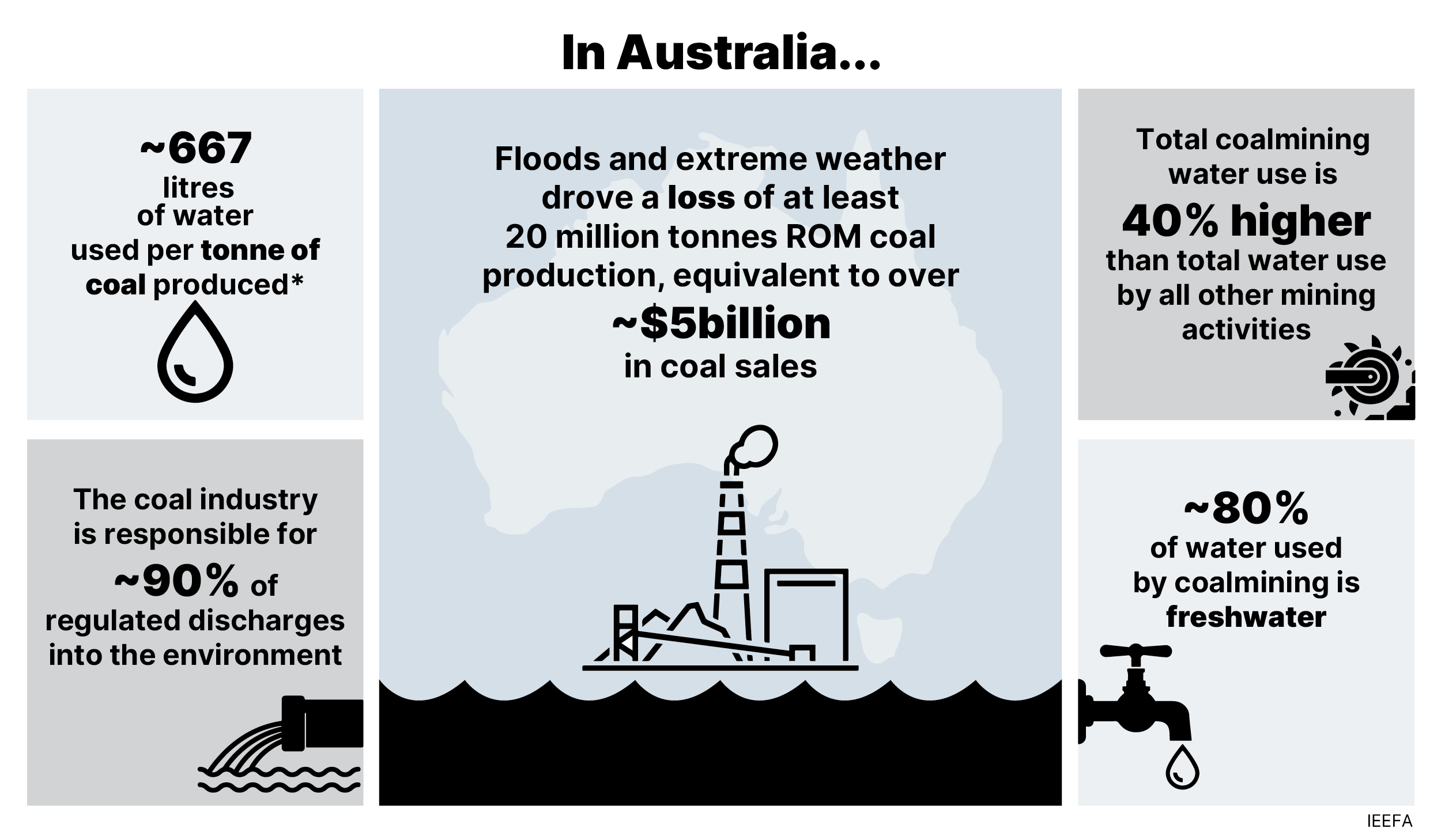

Australian coalminers lost approximately AU$5 billion in potential coal sales across the 2022 calendar and financial years, largely due to flooding and severe weather.

Not one large open-cut coalmine has been fully rehabilitated and relinquished. The $10 billion in bonds held by governments is unlikely to cover the clean-up costs for hundreds of disused coalmines, increasing the financial exposure to operators and investors.

28 March 2024 - (IEEFA Australia): Coalmines are becoming increasingly exposed to water-related risks, driving up the costs and risks for investors, according to new research from the Institute of Energy and Economic Financial Analysis (IEEFA).

Diving deep into the murky waters of Australian coalmining – the most water-intensive mining process in Australia – IEEFA’s latest report found that the industry’s massive water demands are growing at a time when increasingly severe weather events are disrupting production. The major risks are:

- Water access and water costs have been increasing in both NSW and Queensland, even through periods of high rainfall.

- Tighter regulation and approval processes are already delaying or cancelling coal projects.

- Community opposition is spilling over into the investor space, with shareholders demanding greater transparency on companies’ water-related risks.

- Severe weather, flooding and disruptions have cost coalmines an estimated $5 billion in lost sales across the 2022 financial and calendar years.

- Contamination, salination and pollution events have cost the coal industry $9 million, with more than 60 incidents of uncontrolled spills and discharges, requiring greater investment in infrastructure.

- The $10 billion held in government bonds is unlikely to fully cover rehabilitation and legacy issues for up to 300 disused coalmines.

“Water shortages and excess water can both decrease mine production, transforming water into a liability rather than an asset,” says Anne Knight, Lead Analyst, Coal Industry Australia and the report’s author.

IEEFA’s independent analysis found Australia’s largest coalmining companies lost an estimated 20 million tonnes of production from flooding and severe weather across the 2022 financial and calendar years, equating to more than $5 billion in lost sales.

Ms Knight adds: “Climate change is increasing the impact of flooding and severe wet weather events, which disrupt coalmine operations and the entire coal supply chain. These events are becoming ‘the new normal’ in coalmining operations, and insurance for these risks is becoming harder to access and more expensive.

“Mining operators in Australia face significant costs and damages caused by flooding, and significantly higher water costs during droughts. Both are increasing in severity and frequency due to climate change.”

Each year Australia’s mining industry consumes 1,500 billion litres of water – three Sydney Harbours – but the coal sector’s total water consumption is unknown.

Nonetheless, coalmining companies stole 12 billion litres over eight years, incurring penalties and costs of $9 million, or about $750/megalitre, well below other industrial water rates. In the past decade, there have been more than 60 incidents of spills, pollution, contamination and uncontrolled discharges from coalmines, incurring $7.6 million in fines and costs. These figures pale in comparison with lost production, repairs and infrastructure costs.

Many coalmines are clustered in semi-arid regions. As their thirst for water grows so too does the competition for limited resources with communities and other industries such as agriculture, driving up costs exponentially in some areas.

“Water is a fixed input for coalmining operations, but its cost is volatile amid changing climatic conditions and demand from other users,” Ms Knight says.

With tighter regulation and community opposition delaying or cancelling new coalmine projects, investors and shareholders are demanding more transparent disclosure from coalminers, which often underestimate or omit water-related risks in their reporting.

Globally, there was an 85% increase in corporate water disclosure through the Carbon Disclosure Project from 2018-22. Last year, 8,477 companies were requested to disclose water data by investors or business customers.

“Water-related risks in coalmining in Australia can no longer be overlooked,” Ms Knight says. “These are significant and are only going to increase with the impacts of climate change. Existing water data is commonly based on estimations using modelling techniques that do not incorporate the impact of climate change or exclude extreme wet and dry periods.”

It is estimated there are up to 300 disused or abandoned coalmines in Australia, which are still exposed to severe weather events. This is a ticking time bomb for investors, taxpayers and the environment.

Ms Knight explains: “The environmental risks from mines put into care and maintenance is compounded by the lack of reporting and regulation in this space. Mines self-regulate and are required to report non-compliance. However, many reported contamination events were only detected after community monitoring, reporting and complaints.

“A tighter regulatory landscape could increase the financial consequences incurred by mining companies for the frequent water pollution and environmental disasters caused by contaminated water discharges from mine sites.”

The life of a coalmine can exceed 50 years, preceded by decades of exploration and planning, and followed by decades of rehabilitation and post-closure management. Large open-cut mines can cost hundreds of millions or billions to rehabilitate, yet not one large open-cut coal mine has completed rehabilitation and been fully relinquished in Australia.

“Water-related problems are the most common environmental impact when closing mines. These impacts can last for decades or centuries. Given Australia’s preference for open-cut mining and the scale of these operations, the prospects of complete rehabilitation of these sites, if any, need further investigation. The alternative is these mine sites are abandoned, meaning taxpayers may become responsible for funding their rehabilitation,” says Ms Knight.

Read the report: The hidden costs of coalmines’ unquenchable thirst

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contact: Anne-Louise Knight, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)