Jharkhand’s Just Transition: A roadmap for economic growth and diversification

Download Full Report

View Press Release

Key Findings

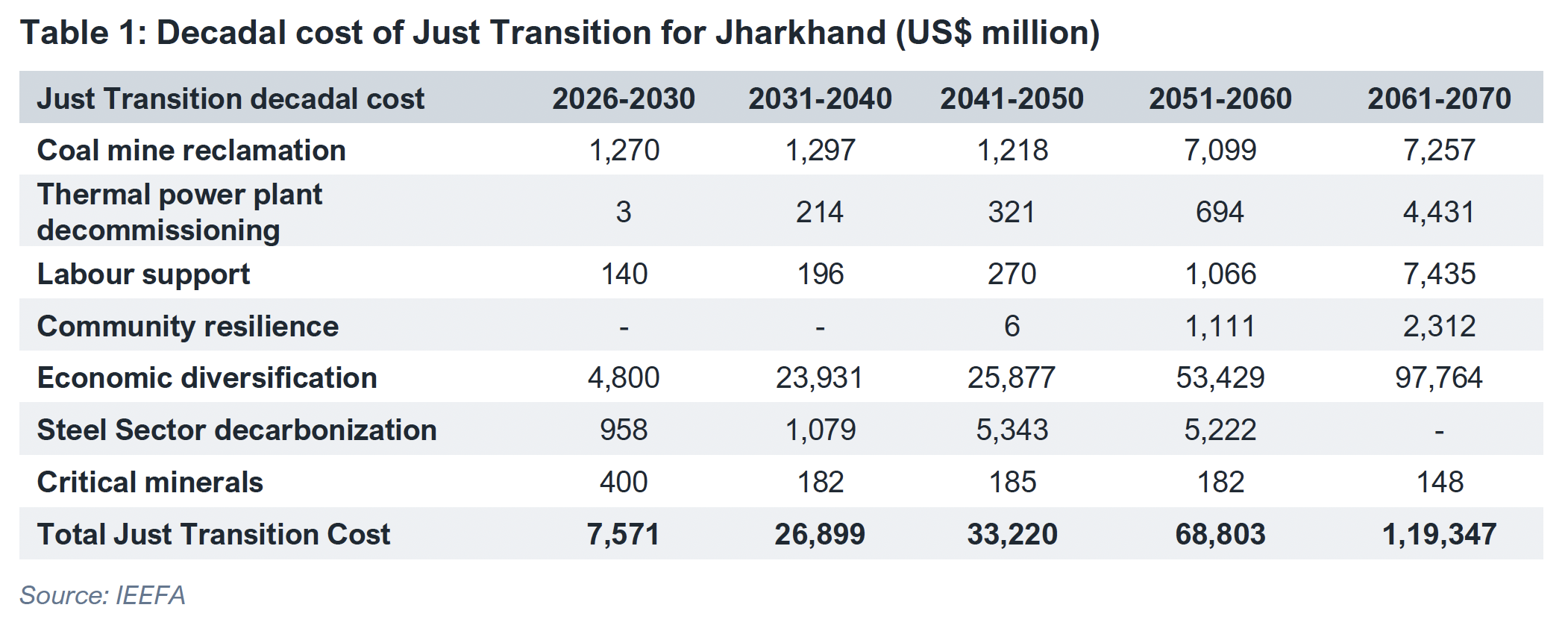

The report estimates that US$256 billion (Rs21.52 lakh crore) will be needed between 2026 and 2070 for Jharkhand’s transition from fossil fuels, covering coal mining and thermal power, decarbonising the steel sector, providing social support, and driving economic diversification into low carbon sectors to maintain both social stability and economic growth.

Coal and petroleum contribute 32% to the state’s own revenue, exposing Jharkhand to major fiscal risks as fossil fuel use declines.

Over US$12.5 billion (Rs1.05 lakh crore) will be needed to reskill, compensate and support livelihoods and communities dependent on the fossil fuel economy.

Public funds alone are not sufficient to finance the transition. A sustainable finance framework involving public finance, private investment, concessional debt and international climate funds is essential.

Executive summary

The global commitment to climate goals necessitates an almost complete shift from a fossil fuel-based economy to a low-carbon one. Aligning with this global effort, India aims to reduce its emission intensity by 45% by 2030 from 2005 levels and achieve net-zero emissions by 2070.1 This shift entails phasing out carbon-intensive assets, building new low-carbon capacity, and mobilising unprecedented levels of capital. For Jharkhand, a state deeply dependent on the fossil fuel economy, this transition is both a high-risk challenge and a high-return opportunity with the potential to enhance energy security, create large-scale employment, and drive long-term sustainable growth.

Fossil fuels contribute 32% to Jharkhand’s own revenue, with coal alone accounting for 17%.2 More than half of the State Goods and Services Tax (SGST) collection comes from fossil fuel-dependent industries. Any decline in coal production or consumption will directly impact the state’s revenue streams, constraining its ability to fund education, healthcare, welfare programmes and other essential social services. The economic repercussions would extend beyond public finances, affecting employment, supply chains and local business ecosystems. Additionally, given that a substantial share of the budget is committed to fixed obligations such as administrative costs and debt servicing, any revenue shortfall would further erode fiscal flexibility, disproportionately burdening vulnerable communities.

Jharkhand lags the national average in green transition metrics. Renewable energy, for instance, accounts for less than 12% of its installed capacity compared with the national average of almost 50%.3,4 This underperformance, however, masks considerable opportunities across multiple low carbon domains. The state possesses renewable energy resources, including abundant solar irradiation, and substantial biomass availability. It has an industrial base suitable for manufacturing low-carbon technologies, a concentration of critical mineral reserves essential for clean energy, and a strong steel sector capable of serving as an anchor for green hydrogen demand.

However, realising this potential will require far more than sectoral investments. The state must begin transition planning as a priority. Building the institutional frameworks, governance systems, regulatory clarity and human capital necessary to manage such a complex transformation takes years, if not decades. Early planning will allow the state to capture first-mover advantages, attract large-scale investment, and build the institutional and human capital needed to drive a just, inclusive and sustainable transition.

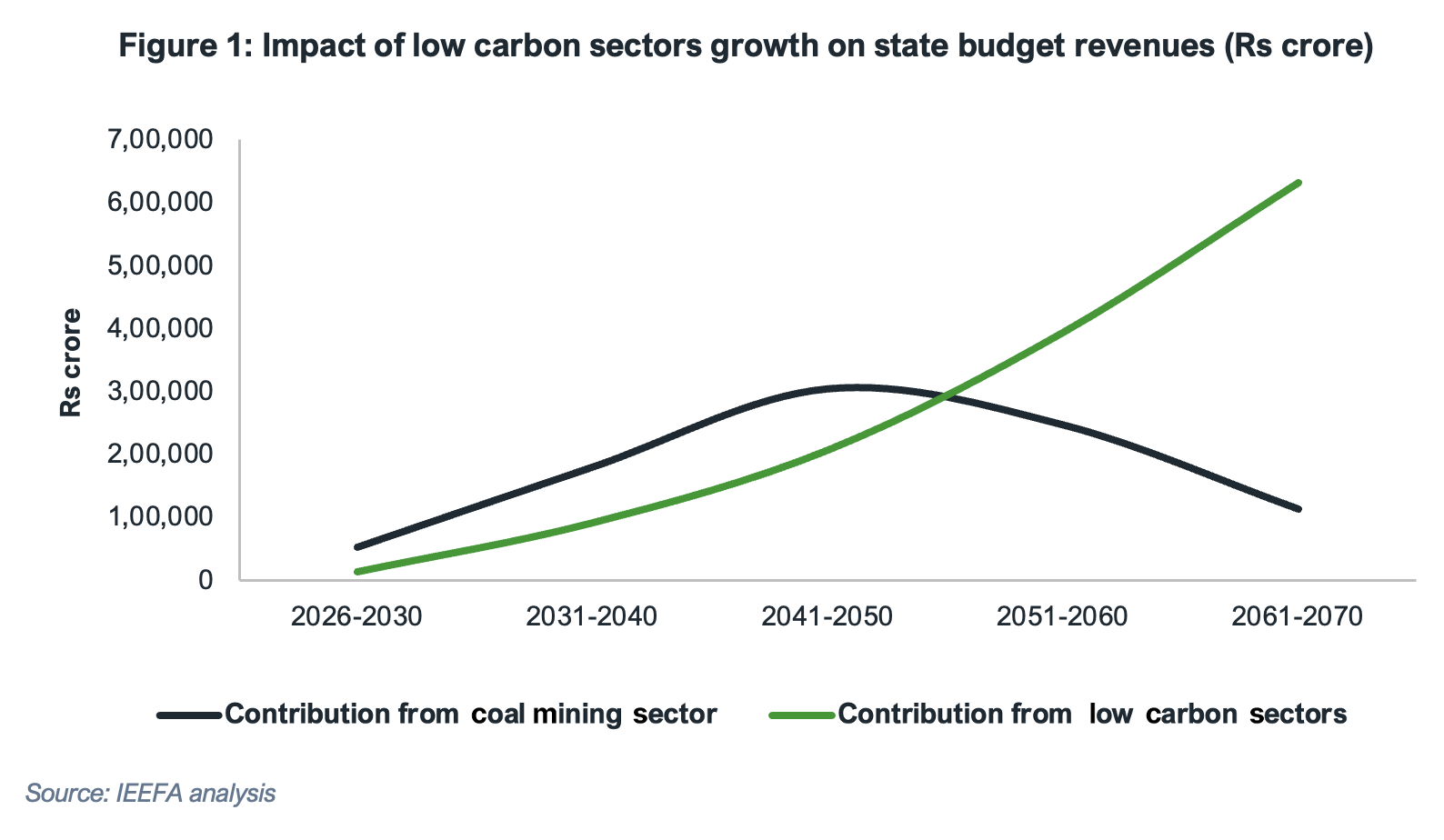

Our analysis and projections show that a concerted effort to grow the low carbon sectors within the state on priority will more than offset revenue losses from coal assets over the coming decades.

As illustrated in Figure 1, revenues from state goods and services tax (SGST), driven by economic diversification into low-carbon industries, are expected to surpass coal mining royalties after 2047, when coal revenues peak before declining through 2070. Over the full transition period (2026-2070), this substitution delivers a net positive impact of about Rs6.7 lakh crore (US$79.3 billion) to the state budget. Importantly, these estimates only account for the state’s own revenues (royalties and SGST) and do not include other budgetary revenue streams, including transfers from the central government.

This report sets out a detailed, actionable roadmap for Jharkhand’s Just Transition. It quantifies the costs of coalmine and thermal power plant closures and remediation, and of steel sector decarbonisation, with these sectors being prioritised for their size, economic importance, and Just Transition implications. It then models decadal transition expenditures, identifies high-potential diversification sectors, and proposes an integrated sustainable finance framework designed to mobilise private capital while ensuring an equitable transition for all stakeholders.

The report focuses specifically on diversifying Jharkhand’s economy by leveraging low-carbon opportunities aligned with the state’s comparative advantages and ensuring a Just Transition. It does not model the impact of fossil fuel expansion or subsequent diversification on the state’s greenhouse gas (GHG) inventory. However, given the dominance of the energy sector—particularly industrial energy use and electricity generation—in Jharkhand’s GHG profile5, and the projected growth of thermal power and the iron and steel industries in the state, transitions within these sectors will play a decisive role in significantly reducing the state’s emissions over the coming decades. Consequently, the cost of transition estimated in the report is only for the specific fossil fuel and economic diversification sectors considered.

Lastly, all assumptions related to expansion of current fossil fuel capacities, technological interventions for decarbonisation, and economic diversification are based on current available data, and economic & technological feasibility. The report is intended to showcase one feasible scenario for Jharkhand’s Just Transition, however there may be other scenarios too that may emerge going forward.

Cost of transition

This report, developed by IEEFA as part of the Jharkhand government’s Task Force-Sustainable Just Transition, estimates the state will require nearly US$256 billion (Rs22 lakh crore), from 2026 to 2070 to transition from fossil fuels without disrupting the social infrastructure. This estimate includes the costs of closing and remediating coalmines and thermal power plants, decarbonising steel sector, supporting workers and communities, and investing in new low-carbon industries.

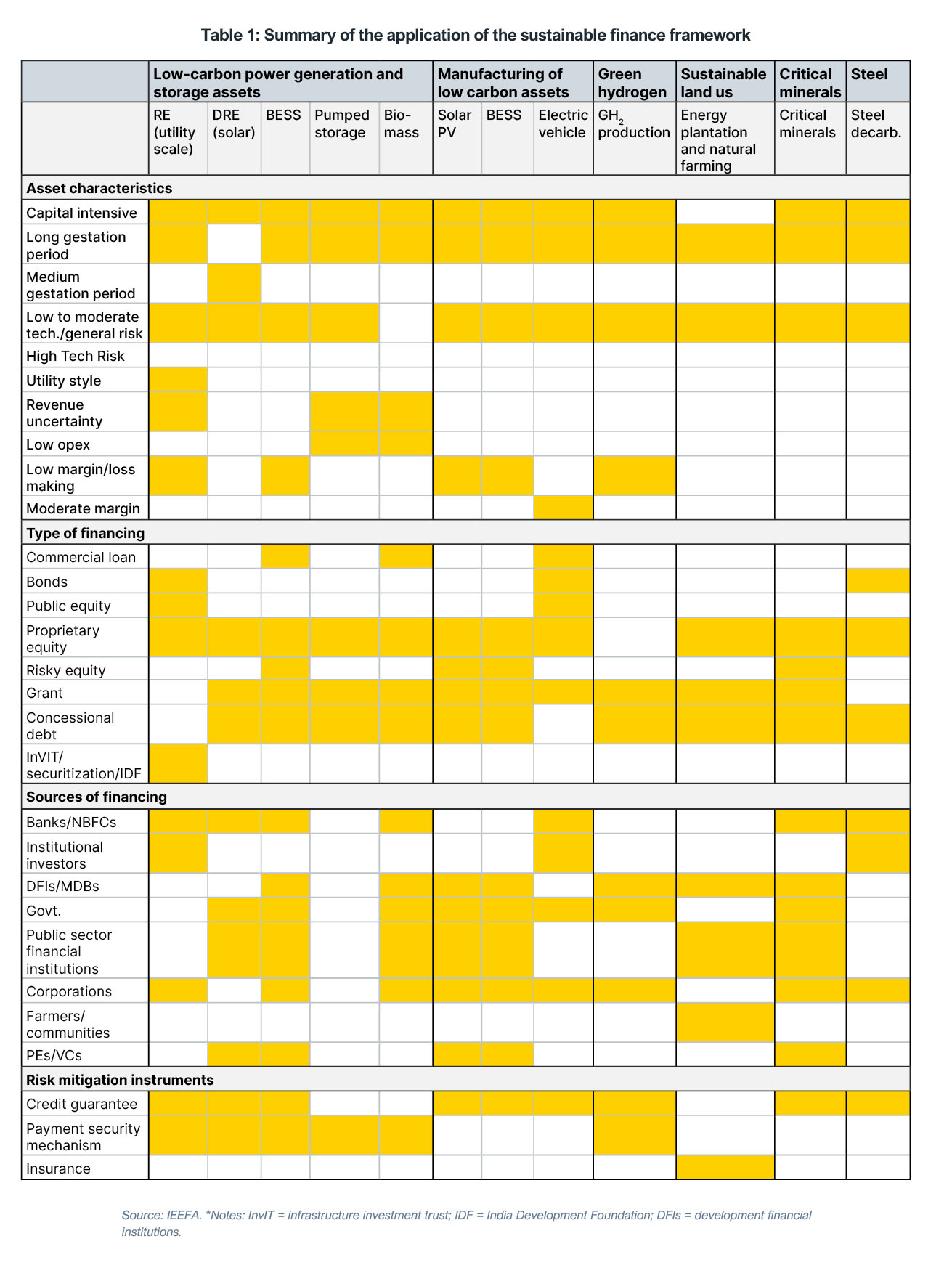

Table 1 provides a breakdown of the estimated decadal cost of transition for Jharkhand across different assets and activities.

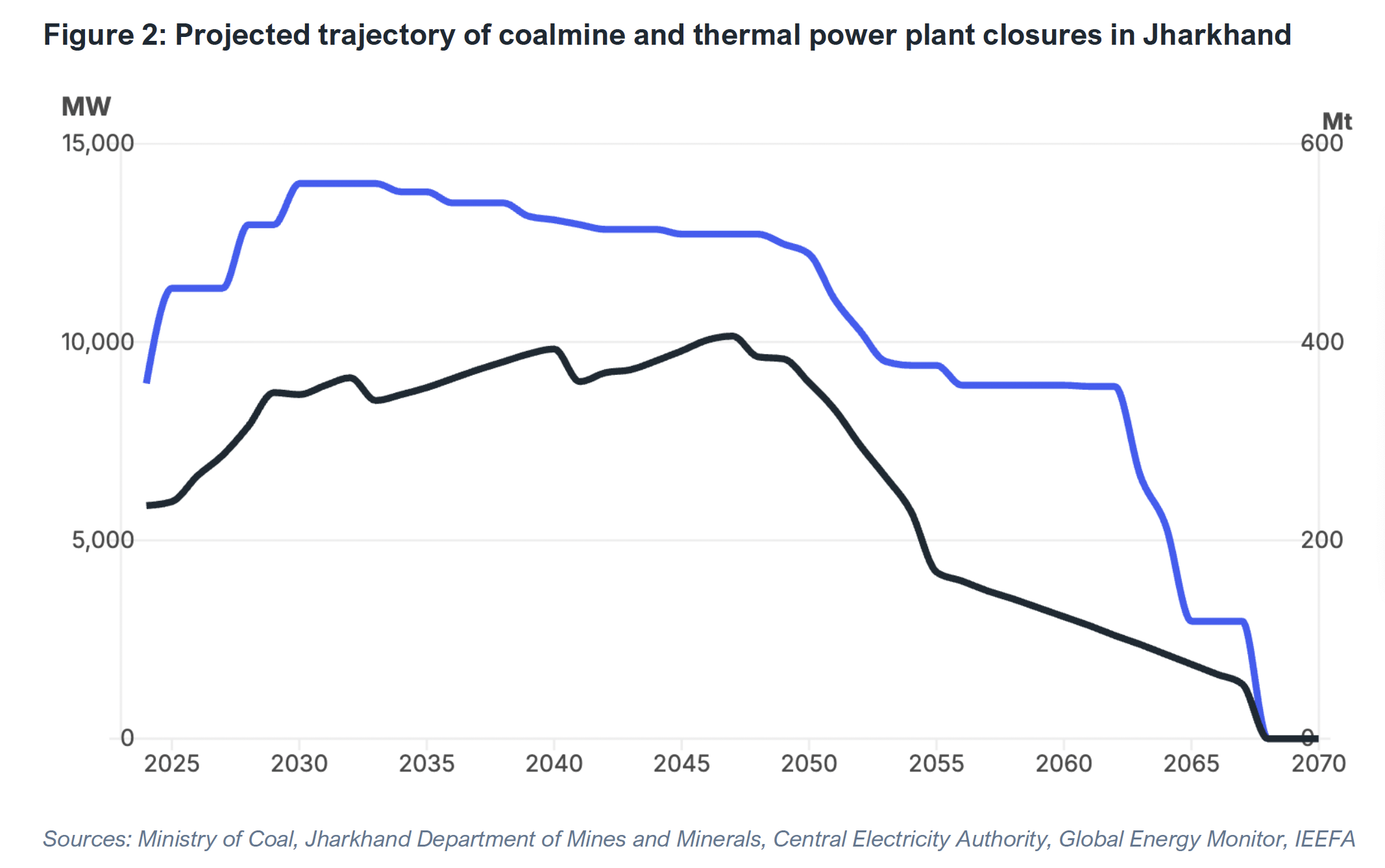

Coal remains at the heart of Jharkhand’s fiscal and industrial structure. The state has 217 coalmines of which 101 are active, with a combined capacity of 259 million tonnes per annum (Mtpa). IEEFA forecasts that coal production in Jharkhand will peak in 2047, after which there will be retirements through to 2070. The assumptions are that the majority of coal mines will be operated for the entirety of their scheduled life, and only a few mines for which the useful life runs beyond 2070 will be closed on an accelerated basis. The total net cost of coalmine closures is estimated at US$18.1 billion (Rs1,526 billion)—after deducting the escrow funds held for mine closures)—covering technical closure, biological reclamation, post-closure monitoring and early-closure compensation. Notably, the regulatory escrow balances are insufficient, with actual technical closure costs projected to be nearly 3 times higher than legacy norms.

Thermal power plants (TPPs) are also a major part of the landscape. As of 2024, Jharkhand operated 34 plants with a combined capacity of 8,955 megawatts (MW). IEEFA projects that TPP capacity will peak in 2030, stabilise until 2040 and decline thereafter. The cost of retiring TPPs between 2030 and 2070 is estimated at US$5.7billion (Rs476 billion) (after offsetting any recovery through scrap sale), including decommissioning, ash pond closure, site remediation and early-closure compensation. Unlike mines, there are no escrow requirements or regulatory guidelines for TPP decommissioning, raising the risk of inadequate closures without clear standards and financing mechanisms.

Labour and community support costs will be significant. Reskilling, upskilling and compensation packages for both formal and informal workers, as well as for those indirectly dependent on coal are estimated to cost US$9.1 billion (Rs766 billion) between 2030 and 2070. Additionally, sustaining community infrastructure and services that rely on coal industry funding will require about US$3.4 billion (Rs288 billion).

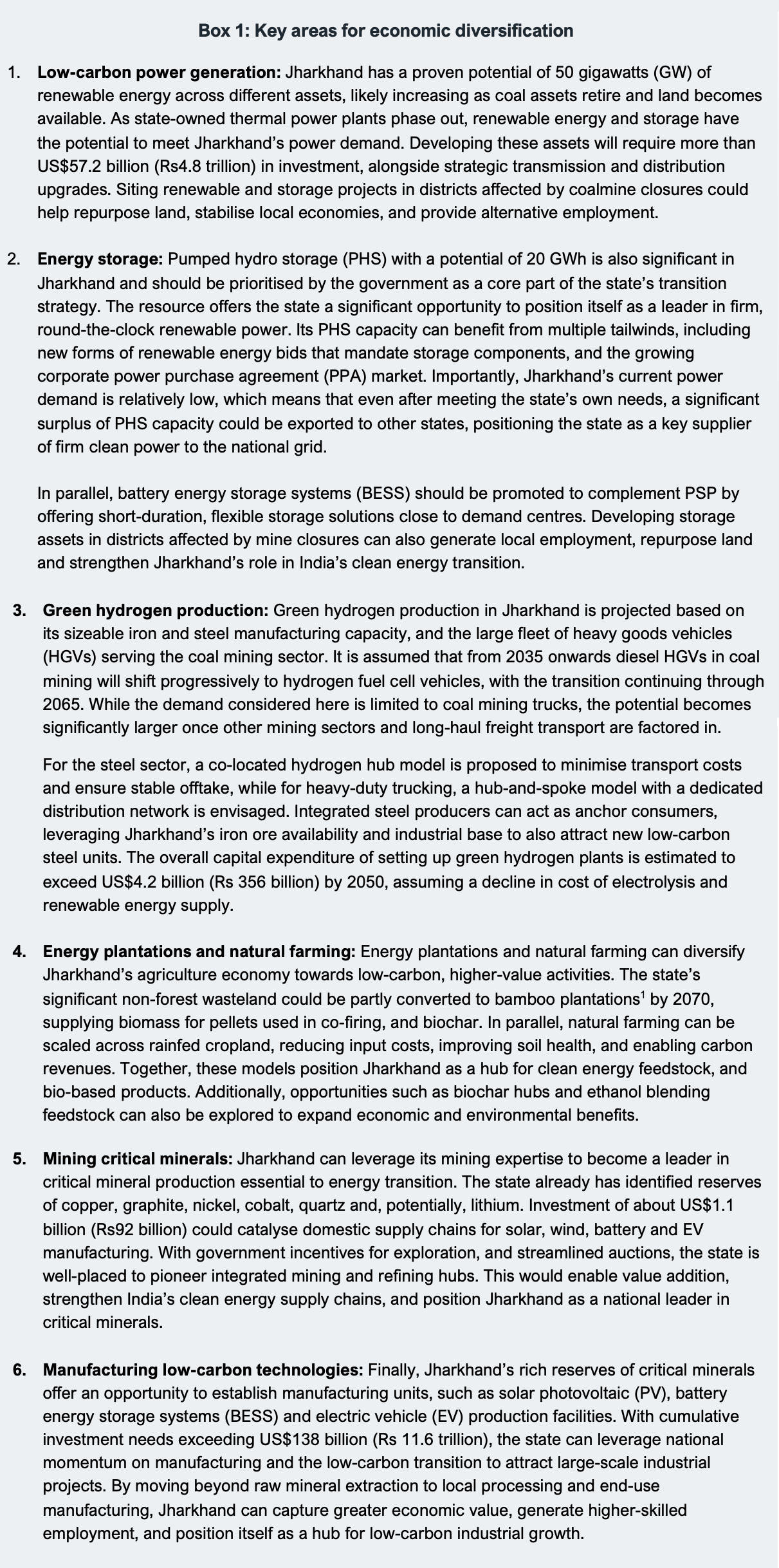

To manage the economic and fiscal risks of phasing down coal while unlocking growth opportunities, this report identifies five priority sectors for economic diversification (see Box 1). These sectors align with Jharkhand’s resource base and industrial capabilities, and India’s broader energy transition trajectory. We have identified the areas based on stakeholder consultations and secondary literature review.

IEEFA also estimates that by transitioning away from fossil fuel-dominated sectors into new low-carbon ones, the state will be able to more than offset the loss of revenues it generates from the fossil fuel economy. Further, our projections estimate that based on this projected growth, the state exchequer will be able to generate additional revenue in the form of taxes and royalties of US$79.3 billion (excluding central transfers and targeted grants) between 2026 and 2070, far exceeding the loss of revenues from coal mining sector.

Financing the transition

Financing this transformation will require a co-ordinated strategy that blends public, private and multilateral capital. Public finance will be essential to fund social support measures, for early retirement of carbon-intensive assets, and enabling infrastructure. Private capital will need to flow into commercial sectors such as renewable power, manufacturing and hydrogen.

For coal asset retirement, this report proposes a state-aligned ‘coal asset retirement facility’ anchored by multilateral development banks (MDBs), blending grants with long-tenor, low-cost debt. This facility would finance technical closure, environmental remediation and early-closure compensation, while ensuring site repurposing for productive use. State-level financing facilities have already been set up across India such as the Tamil Nadu Investment Fund Management Corporation (TNIFMC), which manages an alternate investment fund (AIF) structure based Green Climate Fund. Another example is Kerala Infrastructure Investment Fund Board (KIIFB) bond financed vehicle, along with Kerala Startup Mission (KSUM) Fund-of-Funds (FoF) limited partner model. The SEBI-registered Maharashtra Innovation & Technological Development Fund (MITDF) and the Odisha Startup Growth Fund (SIDBI-managed FoF) are other examples. These templates illustrate multiple governance and capital-stack options and fund structures that Jharkhand can adapt for the coal asset retirement facility.

Renewable power, storage and manufacturing projects will require patient equity, concessional debt, credit enhancement and guarantees, and payment security mechanisms. Green hydrogen projects, while not yet economically viable, will depend on concessional finance and anchor offtake arrangements to become bankable. Agroforestry and community resilience initiatives will require dedicated blended finance facilities, combining public funds with private investment and carbon market revenues.

This report’s sustainable finance framework provides a blueprint that outlines key characteristics, financing types and sources, and necessary risk mitigation for all these identified assets. This framework identifies suitable financing instruments, sources of capital and risk-mitigating instruments to accelerate capital mobilisation for low-carbon technologies. Besides, the framework offers a suitable pathway to finance social welfare and early retirement carbon-intensive assets funded largely by public finances.

We apply this framework across different economic diversification assets in the state.

This report also recommends establishing a state-level transition finance platform to co-ordinate pipeline development, standardise documentation, and aggregate risk mitigation tools. A single-window “green cell” could streamline land allocation, approvals and investor facilitation, supported by regular investment summits with MDBs, development financial institutions (DFIs) and private investors.

Jharkhand stands at an important crossroads in India’s ensuing energy transition. A well-calibrated strategy for a Just Transition today will help the state not just diversify but also grow its economy multifold in the coming decades.