Transforming Jharkhand's economy in line with India's net-zero ambitions

Download Briefing Note

View Press Release

Key Findings

The report estimates that US$256 billion (Rs21.52 lakh crore) will be needed between 2026 and 2070 for Jharkhand’s transition from fossil fuels, covering coal mining and thermal power, decarbonising the steel sector, providing social support, and driving economic diversification into low carbon sectors to maintain both social stability and economic growth.

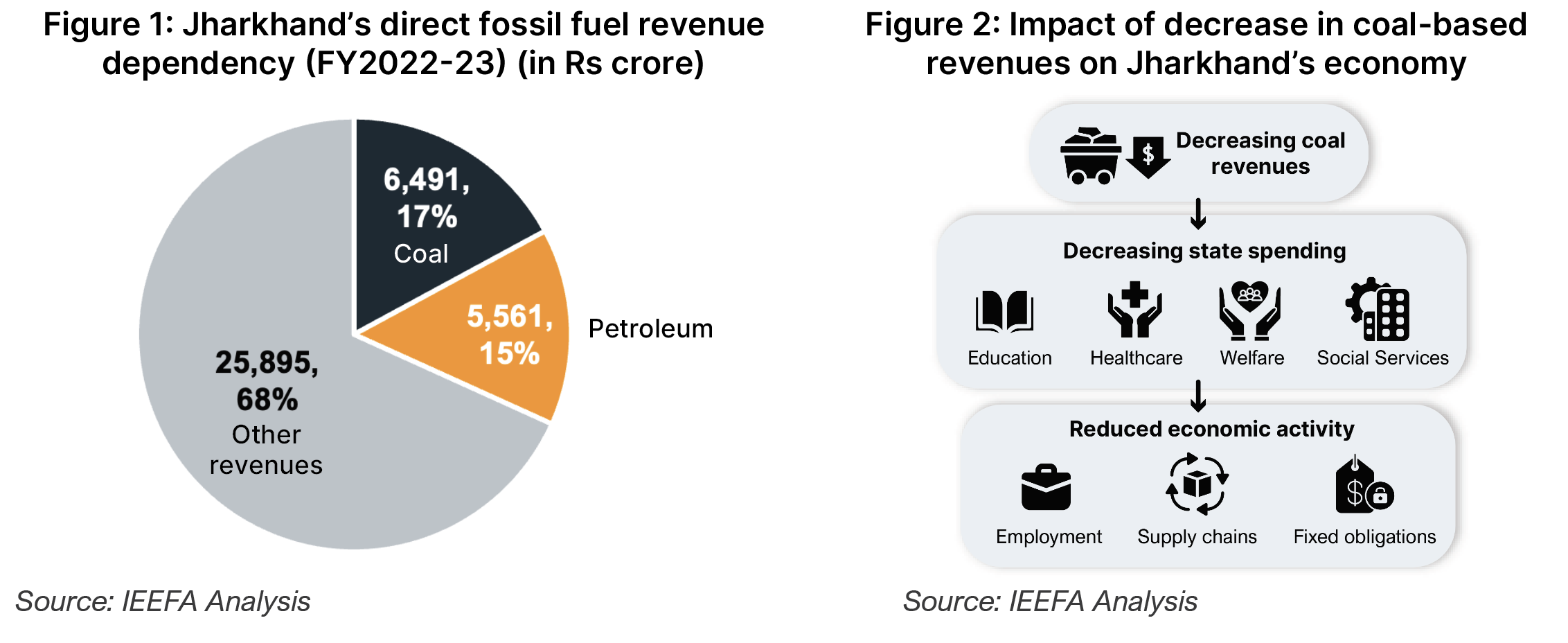

Coal and petroleum contribute 32% to the state’s own revenue, exposing Jharkhand to major fiscal risks as fossil fuel use declines.

Over US$12.5 billion (Rs1.05 lakh crore) will be needed to reskill, compensate and support livelihoods and communities dependent on the fossil fuel economy.

Public funds alone are not sufficient to finance the transition. A sustainable finance framework involving public finance, private investment, concessional debt and international climate funds is essential.

Introduction

India’s net-zero target for 2070 involves phasing out carbon-intensive assets, developing new low-carbon capacity, and mobilising unprecedented levels of capital. For Jharkhand, this transition is both a high-risk challenge and a high-return opportunity, with the potential to enhance energy security, create large-scale employment, and drive long-term sustainable growth.

Fossil fuels currently account for 32% of Jharkhand’s revenue, with coal alone accounting for 17%. Over half of the state’s Goods and Services Tax (GST) collections come from fossil fuel- dependent industries.

A decline in coal revenues will restrict the state’s ability to fund essential social services and dampen economic activity. Since a substantial share of the budget has already been allocated for fixed obligations, such as administrative costs, any revenue shortfall would further reduce fiscal flexibility.

The state stands at a crossroads. Without proactive planning, the decline of the coal industry could trigger fiscal instability and job losses. However, with a thoughtfully crafted Just Transition strategy, Jharkhand can capture high-growth opportunities in low-carbon sectors, create sustainable livelihoods, and position itself to capitalise on emerging markets.