IEEFA: Tidal wave of new LNG supply to flood market amid demand uncertainty

Key Takeaways:

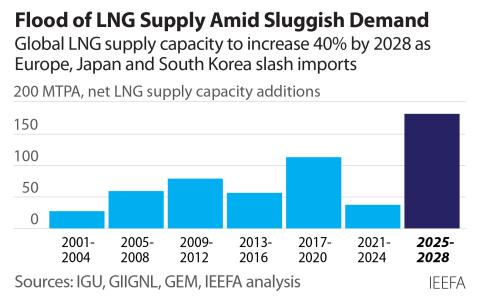

Lackluster demand growth combined with a massive wave of new export capacity is poised to send global liquefied natural gas (LNG) markets into oversupply within two years.

LNG demand in Japan, South Korea, and Europe—which together account for more than half of the world’s LNG imports—is expected to fall through 2030.

In emerging Asia, LNG demand growth will face significant economic, political, financial, and logistical challenges that may not be fully resolved in an oversupplied market.

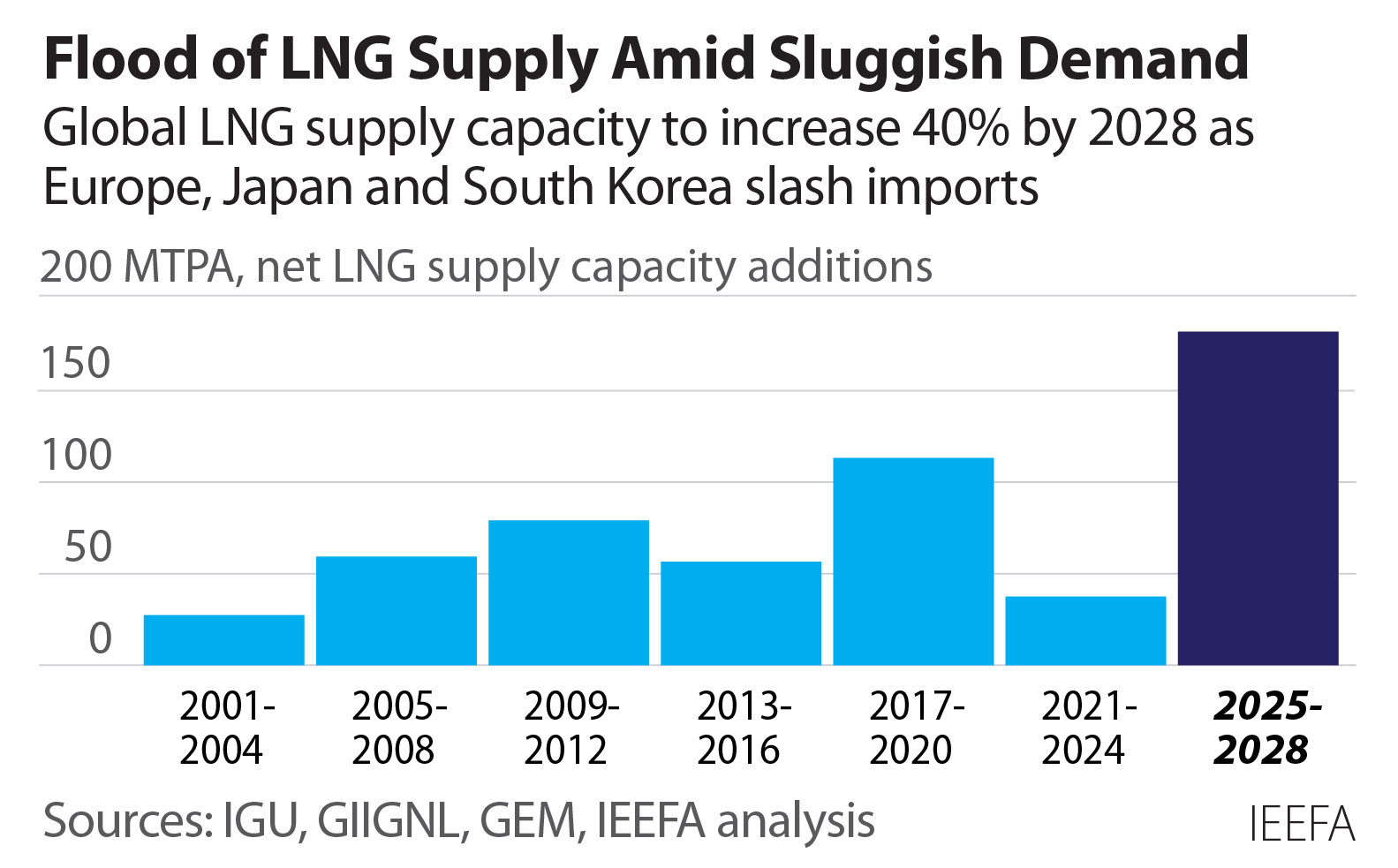

Global LNG supply capacity is set to reach 666.5 million metric tons per annum by the end of 2028—a 40% increase in just five years—despite uncertain demand.

25 April 2024: Sluggish demand growth for liquefied natural gas (LNG), combined with a record increase in global export capacity through 2028, will likely thrust markets into an extended period of oversupply, according to the latest Global LNG Outlook from the Institute for Energy Economics and Financial Analysis (IEEFA).

As major importing regions—including Japan, South Korea, and Europe—aim to reduce LNG demand through 2030, global LNG suppliers and traders will increasingly depend on growth in emerging markets to both compensate for falling imports elsewhere and absorb a flood of new supply.

However, such rapid LNG demand growth in emerging economies is not guaranteed, even in an oversupplied market. Countries in South and Southeast Asia, for example, will face distinct barriers to rising demand, including fiscal and credit challenges, extensive infrastructure delays, and contracting issues, among other obstacles.

The global LNG crisis following Russia’s full-scale invasion of Ukraine in 2022 brought these issues to the fore, spurring many markets to reduce the role of LNG in their development plans and accelerate the development of alternative energy sources:

- IEEFA expects Europe’s gas and LNG demand to fall through 2030. Europe’s natural gas demand has declined 20% since 2021, due to fuel switching, increased nuclear and renewables generation, and energy efficiency measures.

- LNG imports to Japan and South Korea fell 8% and 5%, respectively, in 2023. National energy and climate plans envision steep reductions in the role for LNG in both countries, turning instead to nuclear and renewable energy. Taiwan, on the other hand, aims to cut nuclear power, which may boost LNG demand.

- China reclaimed its position as the world’s largest LNG importer in 2023. However, domestic natural gas production and additional pipeline imports may limit LNG demand growth. Unprecedented increases in renewables capacity are constraining the need for LNG in the power sector.

- In South Asia, fiscal challenges along with the inherent volatility of LNG prices may constrain rapid near-term demand growth, and the role of LNG in power generation is likely to remain low.

- In Southeast Asia, extensive development timelines, contract negotiations, and repeated project delays for LNG-related infrastructure may continue to inhibit demand while strengthening political incentives to pursue alternative energy sources.

As the recent LNG crisis compromised demand growth, high prices also spurred a flood of new supply. Overall, IEEFA expects LNG liquefaction projects already under construction to add 193 million metric tons per annum (MTPA) through 2028—a 40% increase in just five years—bringing the world’s total nameplate liquefaction capacity to 666.5 MTPA.

The largest share of supply additions will come from the U.S. and Qatar, likely pushing Australia to third place among global LNG suppliers. Meanwhile, substantial LNG capacity is under construction in Russia, Canada, and African nations.

In recent years, global LNG traders—including, for example, Shell, TotalEnergies, and many others—have contracted to buy the largest share of LNG volumes from new export facilities, with the aim of reselling cargoes to buyers around the world. But if rapid and sustained demand growth does not materialize, LNG suppliers and traders will likely face an extended period of low prices and slim profits.

Read the Report: Global LNG Outlook 2024-2028

Report contact:

|

Name |

Region |

|

|

Shafiqul Alam |

Bangladesh |

|

|

Christopher Doleman |

Japan |

|

|

Haneea Isaad |

Pakistan |

|

|

Purva Jain |

India |

|

|

Mark Kalegha |

Canada |

|

|

Michelle Kim |

South Korea |

|

|

Ana Maria Jaller-Makarewicz |

Europe |

|

|

Kevin Morrison |

Australia |

|

|

Ghee Peh |

China |

|

|

Sam Reynolds |

Southeast Asia |

|

|

Joshua Runciman |

Australia |

|

|

Clark Williams-Derry |

United States |

Media contact:

|

Name |

Region |

|

|

Susan Torres |

US |

|

|

Sofia Russi |

Europe, Africa |

|

|

Amy Leiper |

Australia |

|

|

Prionka Jha |

Bangladesh, India |

|

|

Alex Yu |

Asia |