Meeting demand growth and greening the grid can go hand in hand

Key Findings

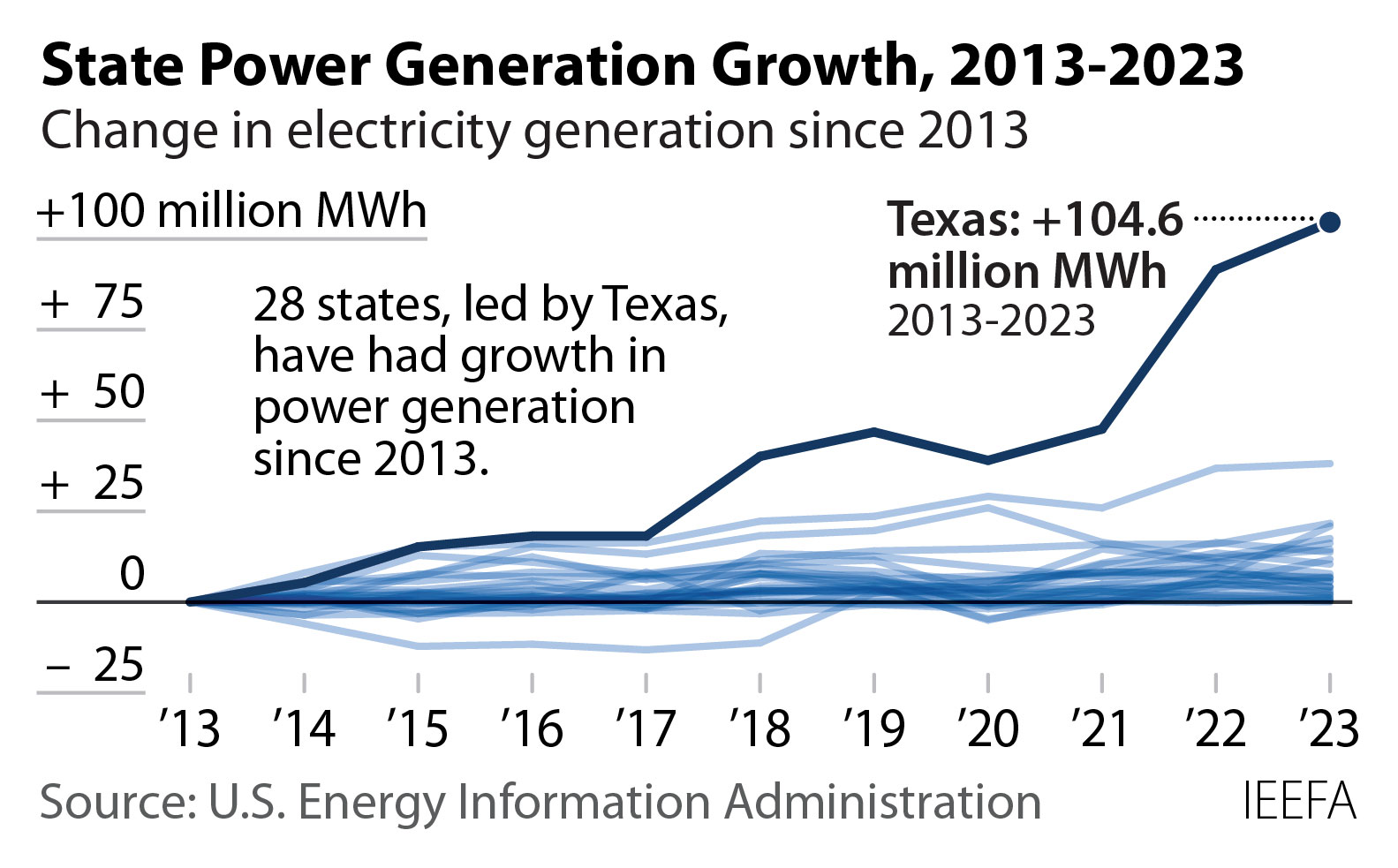

In the past 10 years, electricity generation in Texas has risen 104.6 million MWh, climbing from 391.9 million MWh in 2013 to 496.5 million MWh in 2023.

This increased generation was supplied by renewables, not fossil fuels: Texas was able to meet all its power demand growth, more than 2.6% a year, with renewables.

Despite these green transition success stories, other U.S. utilities have started pushing for authorization to build thousands of megawatts of new gas-fired generation capacity.

Strong demand growth and a renewable energy transition can go hand in hand, and gas is not the only option available for utilities and grid operators.

Rising electricity demand does not preclude a cleaner grid, and we should look no further than Texas for proof.

In the past 10 years, electricity generation in Texas has risen 104.6 million megawatt-hours (MWh), climbing from 391.9 million MWh in 2013 to 496.5 million MWh in 2023. This increase far outpaced growth anywhere else in the United States. It was more than three times the increase in generation in the next fastest growing state, Florida, which had an increase of 38.1 million MWh over the same decade. Indeed, the increase in Texas was larger than the total 2023 generation in 37 states.

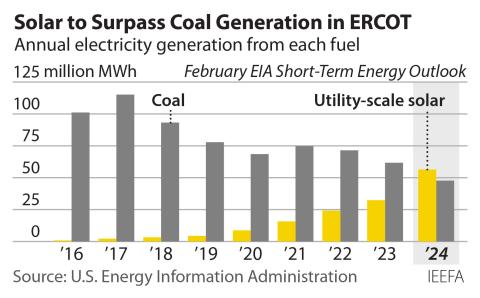

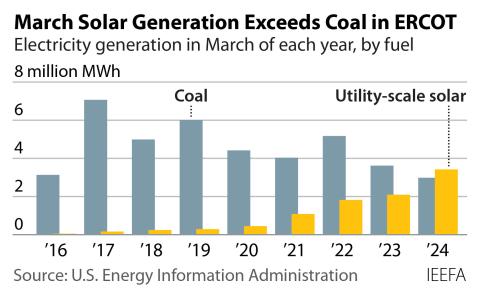

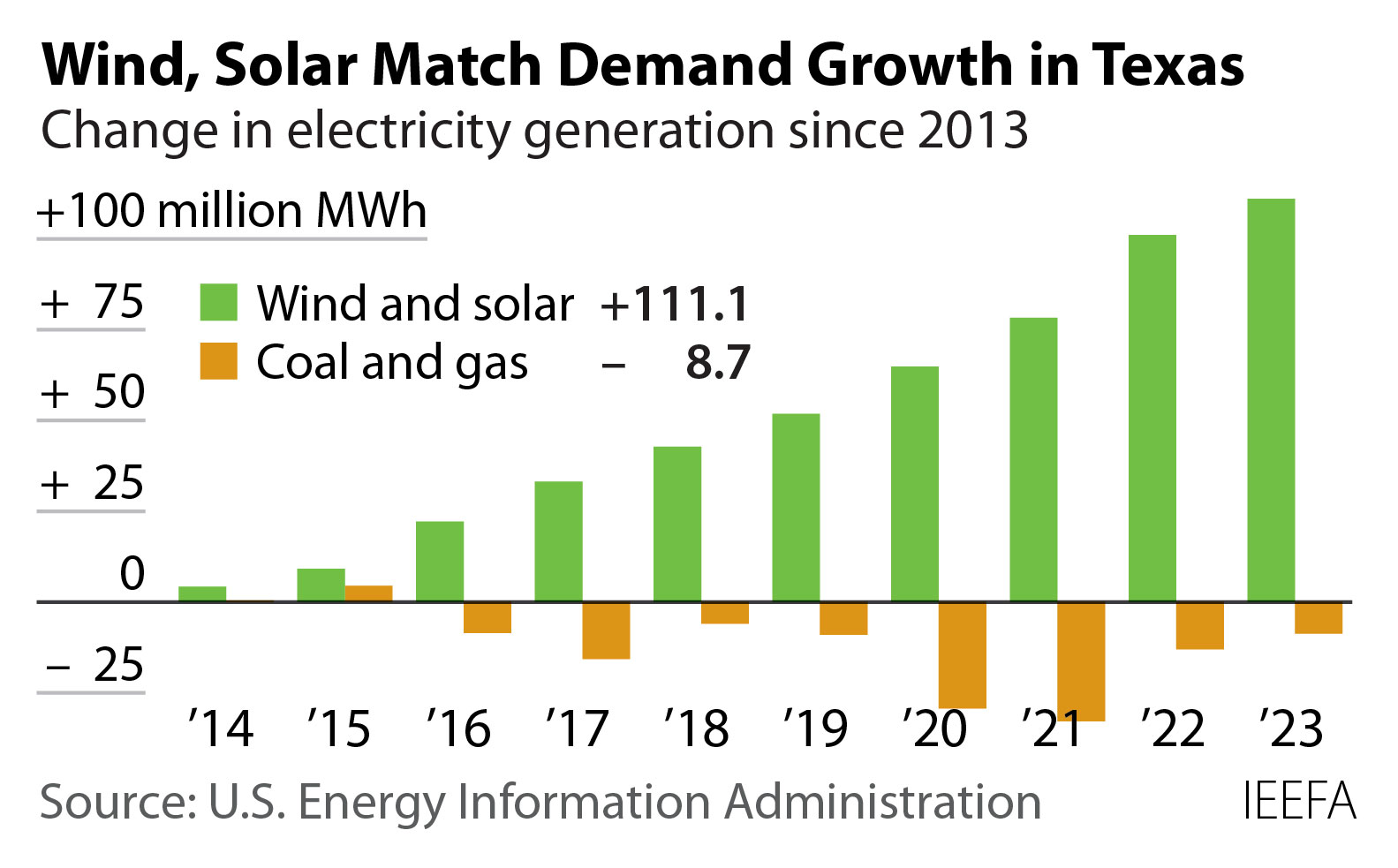

But this increased generation was not supplied by fossil fuels. In 2013, wind accounted for 9.2% of the state’s annual generation, or 35.9 million MWh of the Texas total. Utility-scale solar accounted for a mere 0.2 million MWh, or just four one-hundredths of one percent (0.04%).

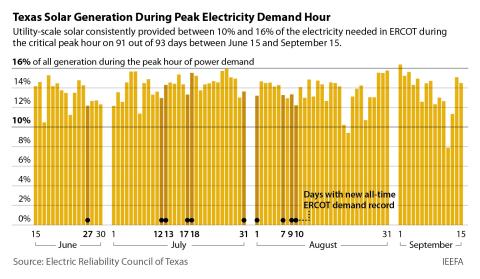

A decade later, in 2023, wind and utility-scale solar generated a combined 147.2 million MWh, or 29.6% of all Texas generation—a three-fold increase in market share despite the substantial increase in the state’s electricity demand. In contrast, the combined generation from coal and gas fell during the same period, from 314.8 million MWh in 2013 to 306 million MWh last year. That occurred because the decline in coal generation outpaced the increase in gas generation. In other words, Texas was able to meet all its power demand growth—more than 2.6% a year—with renewables.

This ability of power producers in Texas to meet the blistering pace of growth over the past decade with renewables is instructive for utilities across the country that are now preparing for what they project will be a sharp upswing in demand growth in the coming decade.

Another way of looking at these numbers is through the lens of market share. When measured this way, the decline for coal and gas is much starker, falling from an 80.3% share of all generation in 2013 to 61.6% in 2023. In other words, the grid got bigger and greener at the same time. That model can be replicated elsewhere.

A different success story is developing in New England. On a sunny day, small-scale, behind-the-meter solar regularly accounts for more than 30% of demand in the six-state ISO-New England (ISO-NE) system, sending more than 5,000 megawatts (MW) into the grid. Looking ahead, the system operator projects that installed solar capacity—most of it behind the meter—will top 10,000 MW by 2028. Odds are that the system will hit that mark sooner, given that past forecasts have significantly understated the pace of solar’s growth in the region.

On top of solar’s strong growth, 1,800 MW of battery storage was cleared in ISO-NE’s latest capacity auction, which covers the year beginning in June 2027. Five years ago, only 5 MW of battery storage were selected in the regional auction. Storage is a perfect complement for New England’s growing emissions-free solar and offshore wind capacity.

Despite these green transition success stories, utilities across the U.S. that recently started warning their regulators of a looming jump in demand over the next decade also began pushing for authorization to build thousands of megawatts of new gas-fired generation capacity.

Georgia Power, for example, said last fall that it now expects demand growth in its service territory to climb by 6,600 MW by 2030, up sharply from the 400 MW of new growth it forecasted just 18 months ago. To meet much of that demand, the utility has asked state regulators to back an expansion plan that includes about 1,400 MW of new gas turbine capacity at its Yates plant; a proposed contract for power from a Florida gas plant; and continuation of a coal-backed power purchase agreement with Mississippi Power, a fellow Southern subsidiary. As for solar and battery storage, those comprise only small portions of the utility’s pending plan, despite the relatively low cost and ease of construction of these resources.

In contrast to Georgia Power’s fossil-heavy development proposal, developers in Texas brought more than 20,000 MW of solar capacity online from 2019-23, and could complete construction on another 21,000 MW in the next two years. Similarly, developers have added almost 5,000 MW of battery storage in Texas since 2019, with roughly 12,000 MW in the pipeline for completion by the end of 2025.

Georgia Power does not seem to be operating at the same speed. In its updated integrated resource plan (IRP), for example, the company said it was in the process of evaluating bids for a single 265MW battery storage project approved by the commission in conjunction with its 2022 long-term resource plan. The utility says it hopes to submit an engineering and construction agreement for that project to the commission for its approval by the end of 2024, and have the system online by the winter of 2026-27.

Other utilities in the Southeast, including Duke, the Tennessee Valley Authority and Dominion Energy have proposed similar gas-focused development plans. None seem to have absorbed the lessons of either the Texas or the New England transition examples: Strong demand growth and a renewable energy transition can go hand in hand, and gas is not the only option available for utilities and grid operators.