Accelerating technology transition has begun to redraw the global steel industry map. We can expect more in 2024

Key Findings

The steel industry’s transition away from coal will also be accompanied by a geographical dislocation of ironmaking from steelmaking.

Ironmaking will increasingly be located close to abundant renewable energy resources, before being shipped to steelmaking operations as hot briquetted iron (HBI).

The global shift will be expedited by a continuing lack of progress in carbon capture utilisation and storage (CCUS) in the sector.

Governments around the world need to make urgent plans to ensure a more orderly transition towards a new steel industry structure.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

Towards the end of 2023, it looked increasingly likely that the UK – which led the world into the Industrial Revolution – will become the only G7 nation without any primary steelmaking capacity.

British Steel announced in November that it would shut down its two blast furnaces and replace them with electric arc furnaces (EAFs). In the same month, Tata Steel UK was set to announce the closure of its two blast furnaces and a switch to EAF, before postponing the move at the last moment. Both plans look like they will have financial backing from the UK government.

The controversial Whitehaven coking coal mine in the north of England looks ever more surplus to requirements under these circumstances. However, the steel technology transition won’t just shift the industry away from coal.

Only a couple of years ago it might have been hard for many to imagine a nation like the UK would be prepared to allow all of its primary steelmaking capacity to shut down. While some might regard this development as questionable industrial policy, it might also simply reflect an emerging reality in the global steel industry – the dislocation of ironmaking from steelmaking.

In a September 2023 presentation, Rio Tinto highlighted the likelihood that a growing proportion of iron will be made in what it termed “advantaged energy locations” before being shipped to steelmaking operations as hot briquetted iron (HBI). This is far from the first time the potential of such a shift has been highlighted, but coming from the world’s largest exporter of iron ore, it is significant.

In August 2023, Rio Tinto signed a multi-year supply agreement for its direct reduction (DR)-grade iron ore pellets from its Canadian operations with H2 Green Steel, which aims to begin making iron and steel using green hydrogen from 2025. The agreement will also see Rio Tinto purchase and on-sell green HBI produced by the steel start-up.

Back in the UK, steel looks like it will be made largely from scrap steel in the very near future, which will necessitate a significant upgrade to the nation’s scrap-processing. However, to continue to make steel for sectors like car manufacturing and defence, the UK may also need another option.

It could simply import steel or even build direct reduced iron (DRI) furnaces to make iron that could run on green hydrogen in the future. However, the UK is unlikely to be seen as an “advantaged energy location” as far as renewable energy goes. With green hydrogen imports looking inefficient and expensive, the UK steel industry could instead import green HBI to supplement scrap so it can continue to produce a wider range of steel products.

Most of Rio Tinto’s iron ore comes from the Pilbara region of Western Australia (WA), which produces mostly lower iron content, blast furnace-grade ores. Yet it is in this state that more developments in the emerging HBI trade can be expected in the near future.

Developments in Western Australia are already underway. In October 2023 POSCO submitted plans for a 2 million tonnes per annum (Mtpa) HBI plant in the state for environmental approval.

Now it is reported that Liberty Steel – which is already transitioning from blast furnace to DRI-based operations in South Australia using green hydrogen – is searching for a new low-carbon iron and steelmaking site in WA. BlueScope Steel is also reported to be considering WA despite saying only two years ago that a switch to DRI-based steelmaking in Australia was not feasible.

Steel start-up Green Steel of WA is planning to set up Australia’s first hydrogen-based steel plant in 2028, while the giant China Baowu is also considering Western Australia as a site for a lower-carbon steel plant.

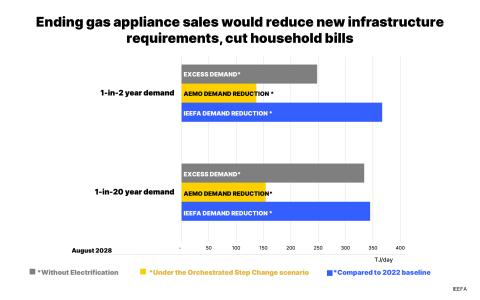

Most proposed DRI-based plants in WA that do proceed will likely plan to begin operations using gas, which would have a significant impact on the state’s gas demand. However, growing gas demand and price rises in WA may incentivise an earlier-than-expected switch to green hydrogen as it gets cheaper.

Carbon capture for steel will continue to stall

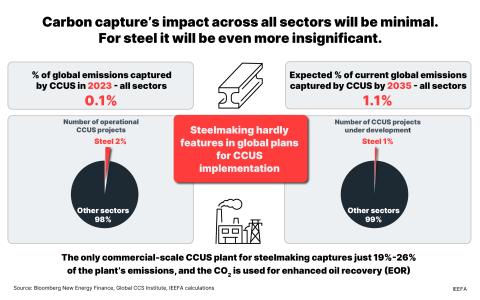

The global shift towards DRI and HBI trade will be driven further by a continuing lack of progress in carbon capture utilisation and storage (CCUS) in the sector. Steelmakers seeking emissions reductions will consequently have little choice but to move away from metallurgical coal and towards DRI-based steelmaking that can run on green hydrogen.

Two recent reports highlight the challenges CCUS faces in the steel sector.

In November 2023, Bloomberg New Energy Finance (BNEF) released its 2023 CCUS Market Outlook report. The report forecasts that, based on announced projects, 420Mtpa of carbon capture capacity will be in place by 2035. However, this represents a mere 1.1% of current global annual emissions from fossil fuel combustion and industrial processes according to BNEF. Furthermore, iron and steel CCUS projects make up a tiny fraction of the total.

Not only that, just 1% of these projects are under construction, with 75% only in the very early stages of development according to BNEF. IEEFA expects that most of these projects will never reach construction.

Also in November, the Global CCS Institute (GCCSI) released its 2023 Global Status of CCS report. The GCCSI is tracking 41 operational commercial-scale CCUS plants and 351 in development globally. Of nearly 400 projects, only four are in the steel sector, including the operational Al Reyadah project in the UAE and two others in the early stages of development.

Despite its perceived success as the only commercial-scale CCUS project in the steel sector worldwide, the Al Reyadah project actually exemplifies the technology’s problems.

Designed to capture emissions from Emirates Steel Arakan’s DRI plants, the project was commissioned in 2016, but in the following seven years no other commercial-scale CCUS facility for steel has been completed anywhere. In addition, the project only captured around 30% of Emirates Steel Arkan’s DRI carbon emissions in 2022. Can a steel plant with that kind of capture rate really be regarded as decarbonised?

Finally, and in common with most existing CCUS facilities, the captured carbon is used for enhanced oil recovery (EOR). Enabling the combustion of more fossil fuels is clearly not a climate solution.

Meanwhile, a role for CCUS to decarbonise blast furnace-based steel operations looks even less likely.

In June 2023, the German think tank Agora Industry found that, since 2020, commercial-scale project announcements for DRI and for CCUS for blast furnace-based steelmaking have developed very differently. To date, virtually all steel companies that plan to build low-carbon steelmaking capacity at commercial scale have opted for hydrogen-based or hydrogen-ready DRI plants, not CCUS.

The 2030 project pipeline of DRI plants has grown to 84Mt, while the pipeline for commercial-scale CCUS on blast furnace-based operations amounts to just 1Mt according to Agora.

Even the International Energy Agency (IEA), which has long claimed there will be a major role for CCUS going forward, appears to be starting to rethink.

In the 2023 update to its net zero emissions (NZE) scenario it stated, “So far, the history of CCUS has largely been one of unmet expectations. Progress has been slow and deployment relatively flat for years... This lack of progress has led to progressive downward revisions in the role of CCUS in climate mitigation scenarios, including the 2023 NZE Scenario.”

For steel decarbonisation the IEA’s updated 2023 NZE scenario reduces CCUS’s role to 37% of steel production by 2050, down from 53% just two years ago. Meanwhile, hydrogen-based steelmaking’s role increases from 29% in 2021 to 44% in the 2023 update. IEEFA expects that that the IEA will continue to reduce emphasis on CCUS for steelmaking going forward.

British Steel’s announcement regarding its shift from blast furnaces to EAFs provided another recent data point indicating CCUS’s trajectory. The company made clear it had looked into decarbonising its blast furnaces – which presumably would have to heavily involve CCUS – but found it “not viable”.

The inability of CCUS to play a meaningful role in steel decarbonisation will mean an industry shift away from coking coal and towards DRI and trade of HBI is on the cards. Key questions include how much iron ore trade will be replaced with HBI trade and how quickly?

European steelmakers are currently focused on starting their own DRI operations that will eventually run on green hydrogen. However, with some recent issues with green hydrogen development and funding in Germany, might there be a rethink towards the import of truly green HBI from more “advantaged energy locations” as the impact of Europe’s carbon border adjustment mechanism (CBAM) spreads?

The sudden and chaotic restructuring of the UK steel industry, which will cause thousands of job losses, should be a warning to other nations. Pressure to decarbonise the steel industry will only grow and looks set to significantly impact the geographical structure of steelmaking and steel raw materials trade globally.

Going forward, governments around the world will need to get onto the front foot to plan a more orderly transition towards a new steel industry structure.

This article first appeared in the March 2024 edition of Steel Times International.