Hydrogen unleashed: Opportunities and challenges in the evolving H2-DRI-EAF pathway beyond 2024

Key Findings

The H2-DRI-EAF process shows significant promise in decarbonising the steel sector, but challenges must be addressed to achieve genuinely green steel through hydrogen reduction.

In the race towards green steel production via DRI-EAF, the utilisation of gas is merely an intermediate measure and should not perpetuate reliance on fossil fuels in steelmaking.

More realism is needed when it comes to green hydrogen: production is likely to be more limited and expensive than often forecast, and its use should be prioritised for sectors like steel where it can deliver major emissions cuts.

Introduction

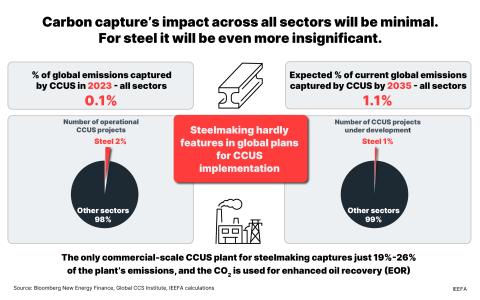

Green hydrogen is set to transform the steel industry. Hydrogen-based direct reduction (DR) technology is already leaving behind other decarbonisation solutions for primary steelmaking such as carbon capture and storage (CCS).

H2-DRI-EAF involves the use of hydrogen (H2) to produce direct reduced iron (DRI), which is then processed in an electric arc furnace (EAF) to produce steel. In the BloombergNEF net-zero outlook, 64% of the total primary steel production projected for 2050 is associated with H2-DRI-EAF, followed at 25% by DRI-EAF equipped with CCS technology. The remaining share is allocated to blast furnace-basic oxygen furnace (BF-BOF) steelmaking and other technologies.

In its revised net-zero roadmap 2023, the International Energy Agency (IEA) envisions that 44% of iron production will be derived from hydrogen-based processes by 2050, followed by other technologies including CCS and direct iron ore electrolysis.

While hydrogen use in ironmaking based on the DR process makes sense to produce low-emissions steel, there are specific hurdles that must be overcome to facilitate this shift. The foremost challenges include ensuring an adequate supply of DR-grade iron ore, and establishing a sustainable green hydrogen value chain for steel production.

The iron ore mining industry has been a major sector with established corporate entities for many years. To cater to emerging demand for green iron, companies are adopting diverse strategies, including opening new iron ore mines with high-grade ores such as Iron Bridge, Australia, and Simandou, Guinea. Furthermore, inventive methods are being explored such as microwave and biocarbon technologies for producing low-emission pure iron, along with the use of smelting reduction with lower-grade ores.

Compared to the iron ore sector, green hydrogen is relatively new. However, it will play a pivotal role in effectively decarbonising the steel industry, which demands closer examination.

The challenge of creating a green hydrogen value chain for steel

The decarbonisation of the steel sector will necessitate additional and more dedicated gigawatt-scale green hydrogen projects. Green hydrogen is still in its early stages of development, and increased investment is crucial for its integration into the steel industry. In the H2-DRI-EAF process, one tonne of steel requires nearly 300 megawatts (MW) of electrolyser capacity operating around the clock.

Currently, among the commercial-scale green steel projects, only H2 Green Steel has outlined a comprehensive plan, proposing an electrolyser capacity above 700MW for steel production and aiming to transition directly to hydrogen instead of gas as an alternative reducing gas. Thyssenkrupp is exploring the possibility of outsourcing hydrogen supply for its plant in Duisburg, Germany, opting not to invest directly in the hydrogen value chain. This will entail considering long-term supply contracts for both green and “blue” hydrogen from domestic and international sources.

The hydrogen economy faces constraints such as limited electrolyser manufacturing capacity, and entails significant electricity consumption, posing challenges for renewable energy supply.

To sustain the operation of large-scale green hydrogen-based DR plant, a consistent supply of renewable electricity must be guaranteed throughout the year. The variability of renewable energy sources, such as solar and wind, necessitates oversizing of capacity and the implementation of energy storage solutions to ensure a continuous energy supply. This necessity contributes to an escalation in the initial investment costs for renewables that can dwarf the CAPEX needed for the steelmaking facilities.

As per the US government’s updated Inflation Reduction Act (IRA), tax credits are available exclusively for hydrogen projects meeting specific criteria covering three key factors. First, the project must involve dedicated renewables constructed no more than 36 months before the commencement of electrolyser production (Additionality). Second, the renewables and electrolysers should operate within the same grid (Grid Access). Third, the project must align precisely with renewable power generation in terms of production time (Time Matching). The new requirements push developers to build their hydrogen plants with dedicated renewables nearby.

As of December 2023, the Hydrogen Council reported that despite a substantial number of projects announced, amounting to 305 gigawatts (GW) in total pipeline capacity, the combined electrolyser capacity for green hydrogen has only surpassed 1GW. This capacity is sufficient to decarbonise just one steel mill with a capacity close to 3 million tonnes per annum (Mtpa). The hydrogen development sector is also grappling with challenges such as cost inflation and rising financing expenses that push up the price of the hydrogen. The estimated levelised cost of producing renewable hydrogen (LCOH) is about USD4.5/kg to USD6.5/kg if built today. It is expected to decline to USD2.5/kg to USD4.0/kg towards 2030.

Chinese electrolysers present an opportunity as they are two to five times more cost-effective than their Western counterparts; however, their performance lags behind that of Western models.

Owing to the inflation and the uncertainty regarding government support, some projects are deferring their final investment decisions (FIDs). Lenders are anticipating support from offtakers for green hydrogen projects, but the price gap between production costs and offtakers’ desired rate remains substantial. End users are hopeful for more supportive regulations to facilitate a smoother transition, potentially resulting in an uptick in project finance approvals in 2024.

With all of these challenges facing green hydrogen production, it is crucial to prioritise the available capacities for sectors that can yield a substantial reduction in carbon emissions, such as the steel industry.

German think tank Agora Industry has underscored that steel stands out as the sector with the greatest potential for carbon reduction among various hydrogen applications. Interestingly, even in sectors where direct electrification is not feasible, shifting from coal to hydrogen – as seen in steel sector – yields more benefits compared with transitioning from other fossil fuels, including oil and gas, to hydrogen.

In addition to distributing valuable green hydrogen across various sectors according to priority and carbon reduction potential, developers should reconsider exporting hydrogen for long distances. Particularly for projects under development in regions like MENA, hydrogen transportation is not an optimal solution, with inefficiencies and energy losses that add costs to the hydrogen value chain. Instead, using hydrogen domestically for producing hydrogen-reduced iron is strongly recommended as a preferable approach.

As an alternative, some steelmakers are opting to shift the ironmaking process to locations with access to more affordable and reliable energy sources, importing pure iron as a feedstock in the form of hot briquetted iron (HBI). The concept that is emerging sees a decoupling of ironmaking from steelmaking processes.

To bring this into reality, some steel producers are focusing their efforts on Australia, Brazil, the Middle East and Africa, all of which are positioned to establish themselves as green hubs for steel raw materials. POSCO is in the process of outlining a USD12 billion investment for green HBI in Australia. Plans for the development of 2Mtpa of HBI and 0.7Mtpa of iron ore pellets were submitted for environmental approval in October 2023.

Gas is only an intermediary solution

The growth of the green hydrogen value chain is a process that will extend over several years. This is reflected in the basic design of numerous newly announced green iron and steel projects, which are strategically planned to be hydrogen-ready. Most of these projects are set to commence operations initially utilising natural gas (NG) – the exception being the Nordic countries. Continuous access to affordable renewable energy derived from hydro power frees the Nordic nations from any reliance on gas at the outset.

Midrex, the largest manufacturer of DR plants, offers flexibility in its process, which can function with varying hydrogen ratios in the reducing gas mix. This allows for a gradual transition from gas to hydrogen whenever green hydrogen production becomes cost-competitive.

Tenova and Danieli, the joint developers of the Energiron DR technology, claim that all Energiron DRI plants are hydrogen-ready by design and can start using hydrogen as reduction gas without equipment modifications.

Experiments such as elevating the hydrogen share to 60%, in a trial conducted by HBIS, validate the potential of utilising a gas mixture in Energiron shafts to decrease carbon emissions in the ironmaking process. In May 2022, ArcelorMittal Long Products Canada, equipped with two Midrex shafts, successfully conducted tests replacing gas with hydrogen partially.

Large-scale greenfield DRI projects and their reducing gas

The concluding remarks of COP28 highlighted the imperative to shift away from fossil fuels in energy systems, signalling the commencement of a pivotal phase. This underscores the collective responsibility of all nations to swiftly phase out fossil-based industrial operations, ensuring alignment with the goals of the Paris Agreement.

Despite the current high price of hydrogen, it is anticipated that the cost will become increasingly economical as electrolyser technology matures in the near future, prompting a shift towards hydrogen. Conversely, as the energy system moves away from fossil fuels, a global glut of gas supply is expected by the end of this decade. Investing in new capacity development is likely to result in stranded assets.

Even in regions with access to gas reserves, like Western Australia (WA), where projects such as the new POSCO’s HBI plant have been announced, securing gas is challenging due to the extremely tight supply, as most gas produced in WA is exported as liquefied natural gas LNG. Conversely, regions such as the Middle East boast plentiful and affordable gas resources that have historically been employed in iron production.

The first wave of green steel initiatives is emerging in Europe. Following the Ukraine war, Europe aims to replace Russian pipeline gas partially with increased LNG imports, mainly from the US. Introducing new gas demand from steelmakers could strain the overall supply, necessitating reconsideration in studies for transitioning to the NG-DRI pathway even as a bridging solution to true green steel. It’s crucial to note that utilising LNG as a feedstock may raise the final steel cost, given the additional expenses incurred during liquefaction, transportation and regasification processes for LNG compared with delivering gas via pipeline.

Europe is decreasing its reliance on gas, as renewable sources are claiming a larger share of the energy mix on the continent. The EU aims to fulfill 42.5% of its energy demand from renewable sources by 2030.

Given the transformations in the energy sector, the concept of utilising “blue” hydrogen – made using gas, with the emissions captured with CCS – in steelmaking is irrational. CCS remains an unproven technology with a track record of underperformance and low capture rates.

According to a report from the US Department of Energy (DOE), the majority of blue hydrogen projects are not deemed clean due to their high upstream emissions and do not qualify for tax credits. The EU also does not provide extensive subsidies for blue hydrogen.

Moreover, in line with the EU’s revised Renewable Energy Directive (RED III), industries such as steel are mandated to have at least 42% of their hydrogen use sourced from renewable energy by 2030, with a further increase to 60% by 2035. This updated directive effectively excludes the possibility of blue hydrogen development for steelmaking in the EU.

The utilisation of gas-based DRI is not a definitive solution for achieving steel decarbonisation due to its significant carbon emissions. Green steel producers should have a clear strategy to transition towards green hydrogen or, at the very least, proactively plan to incrementally incorporate hydrogen to curtail the reliance on gas in the production process.

H2-DRI-EAF represents a narrative of allocating limited resources to create valuable products. Currently, green hydrogen comes at a high cost, and there is a scarcity of DR-grade iron ore. By judiciously allocating these two resources to green steel facilities, and with the backing of supportive yet rigorous regulations, the transition to green steel can continue to gain momentum in 2024.

This article was first published in Steel Times International.